Compound Growth - Investing for the long term

Like most things in life, creating wealth through investing requires patience. Generally speaking, investing in the financial markets has historically provided a positive return when you look back over long periods of time¹. This is the fundamental idea with a retirement account - you invest during your prime working years and aim to grow your savings over time so you can potentially retire or reduce your working hours in the future.

Understanding how compound growth works is key to understanding the benefits of long term investing. To help explain compound growth, let’s start with a simple hypothetical example. Let’s say you invest $1,000 and earn a 10% return after the first year on your initial investment. At the end of the first year, your account balance would be $1,100, see calculation below:

Beginning balance in year 1 = $1,000

10% return = $100

End of year balance = $1,000 + $100 = $1,100

Now let’s say in year 2 you earn another 10% return in your investment account. Your new balance at the end of year 2 would be $1,210, see calculation below:

Beginning balance in year 2 = $1,100

10% return = $110

End of year balance = $1,100 + $110 = $1,210

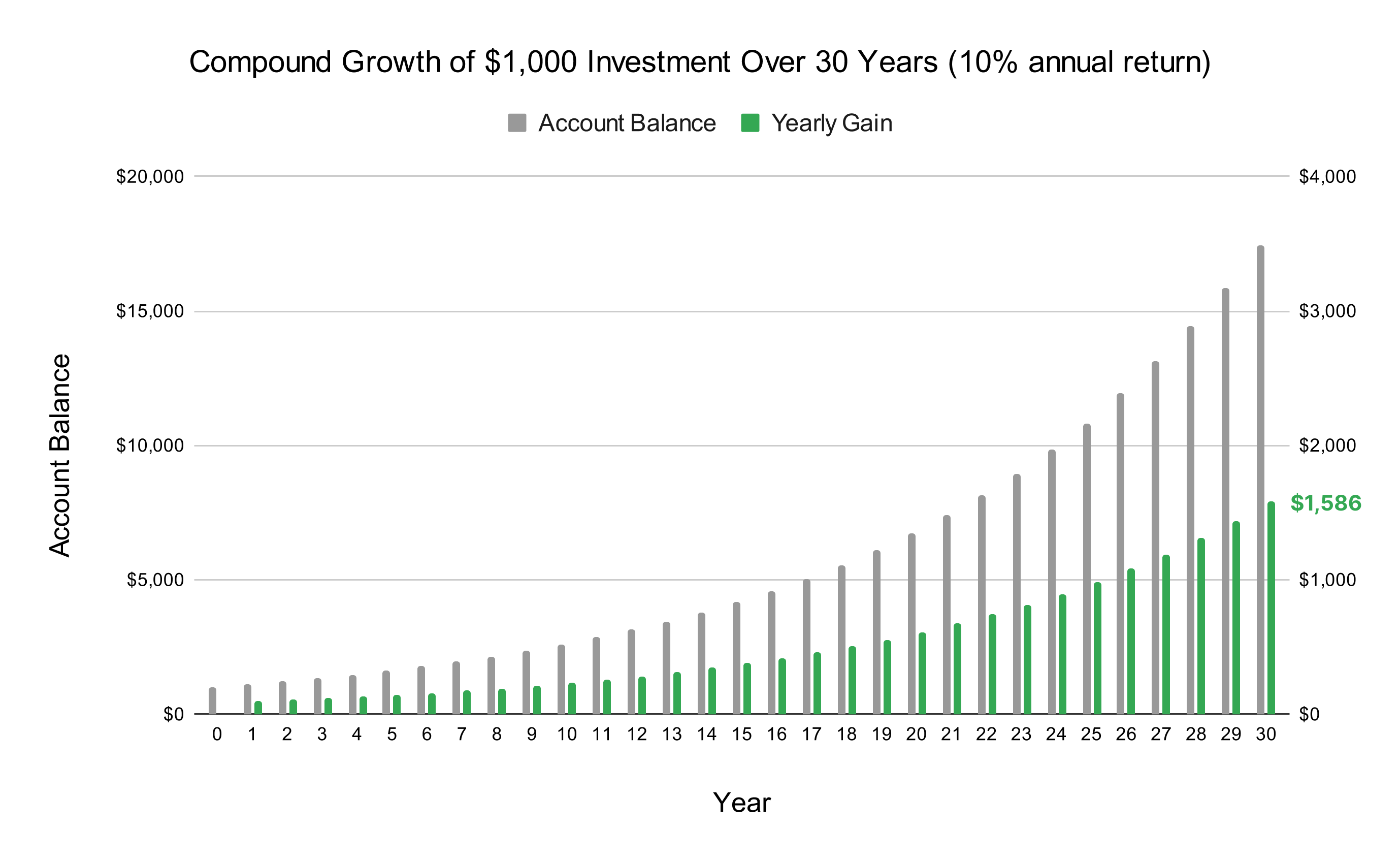

The important thing to notice is that in year 2 a 10% return on your account balance resulted in $110 in gains because the 10% was applied to your new balance of $1,100 at the start of year 2 (recall that in year 1 the 10% return resulted in $100 in gains). This is the concept of compound growth: as your account balance increases, the dollar amount of gains grows too, even if the percentage of returns stays the same (or even reduces). You might be thinking $10 more in gains is not that exciting, but let’s look at how compounding growth works over a period of 30 years in the following chart.

(Illustrative example assumes 10% annual return. See disclaimer.)

If we assume a 10% return every year on the investment, what was only $100 in gains in year 1 becomes $1,586 in gains in year 30. That’s impressive, but not the most amazing part.

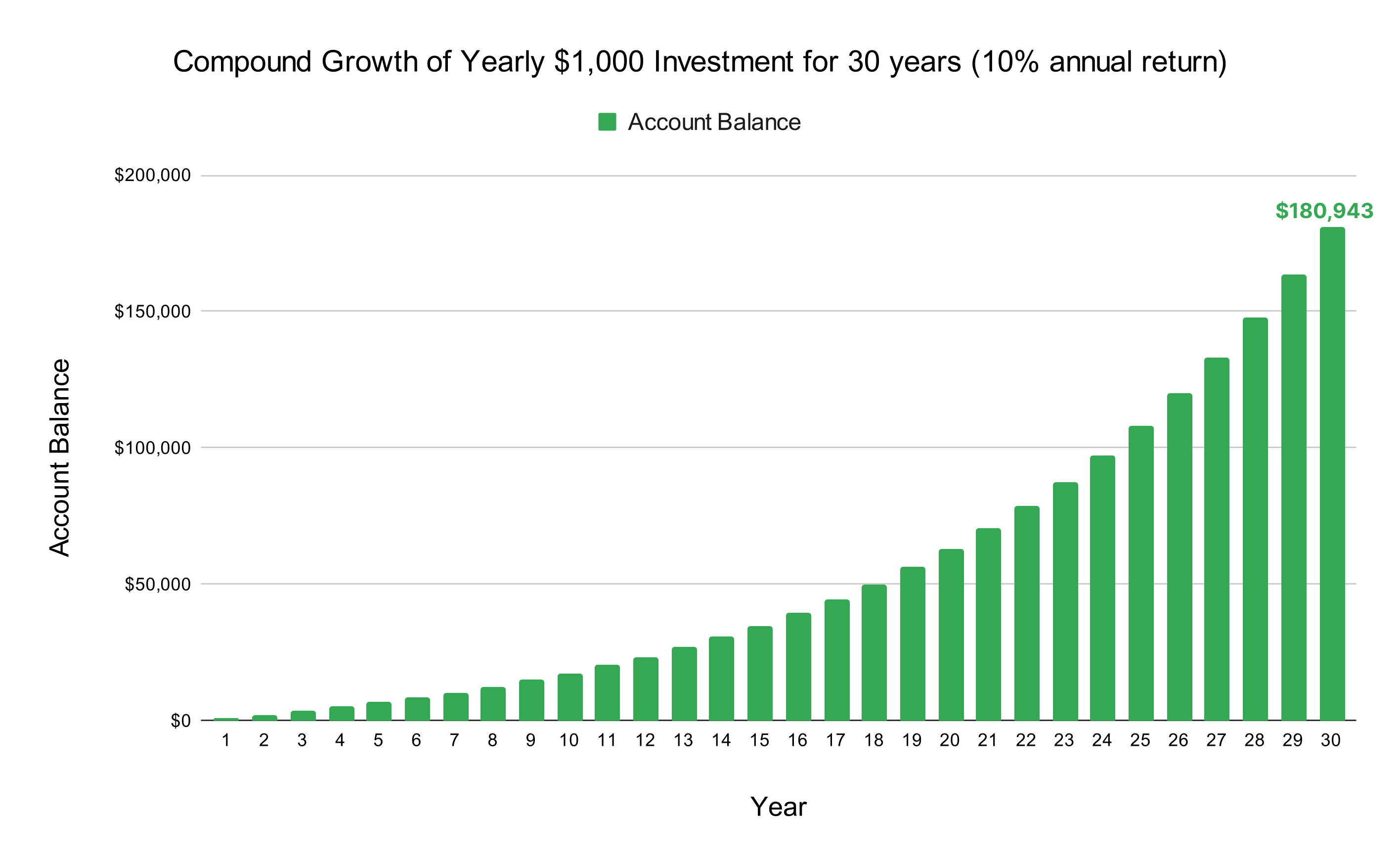

Our initial example assumed you would only invest $1,000 at the time you created the account. But in your retirement account you could continue to invest every year, which would make the effect of compound growth much larger. Let’s assume you invest $1,000 per year over the same 30 year period with a return of 10% each year. Take a look at the large gains in the following chart.

(Illustrative example assumes 10% annual return. See disclaimer.)

In year 30 the value of your account could be $180,943 under these hypothetical assumptions. Recall that you only invested $30,000 ($1,000 each year). This is the true power of compound growth and how long term investing can help you save for retirement.

Please feel free to share this post with your clients and help improve their financial education.

Although we're big fans of AI, we want you to know that we write all of our blog posts ourselves and only use AI for research and editing.

Back to Blog

The figures and scenarios shown above are for illustrative purposes only, and do not reflect actual customers or returns. It assumes consistent annual returns and does not reflect the impact of market volatility, fees, taxes, or investor behavior. Past performance does not guarantee future results and individual circumstances will vary greatly and depend on personal and market circumstances. Investing involves risk and investments may lose value, including the loss of principal. ¹This reference pertains to the historical performance of the broad U.S. stock market and will vary based on the specific time period and investments considered. Past performance is not a guarantee of future results, and there is no assurance that future market periods will yield positive returns.