Blog Posts

The Risk of Relying on Social Security Income for Retirement

An update on the latest Social Security benefits statistics and the risk of relying solely on Social Security to cover your living expenses as a retiree.

CalSavers (for California residents)

A summary of the mandatory state retirement program for California businesses and how businesses can qualify for an exemption by offering their employees a retirement plan from Crecer.

Retirement Account Tax Savings

A summary of the tax deductions and credits available for investing in a Traditional or Roth IRA retirement account.

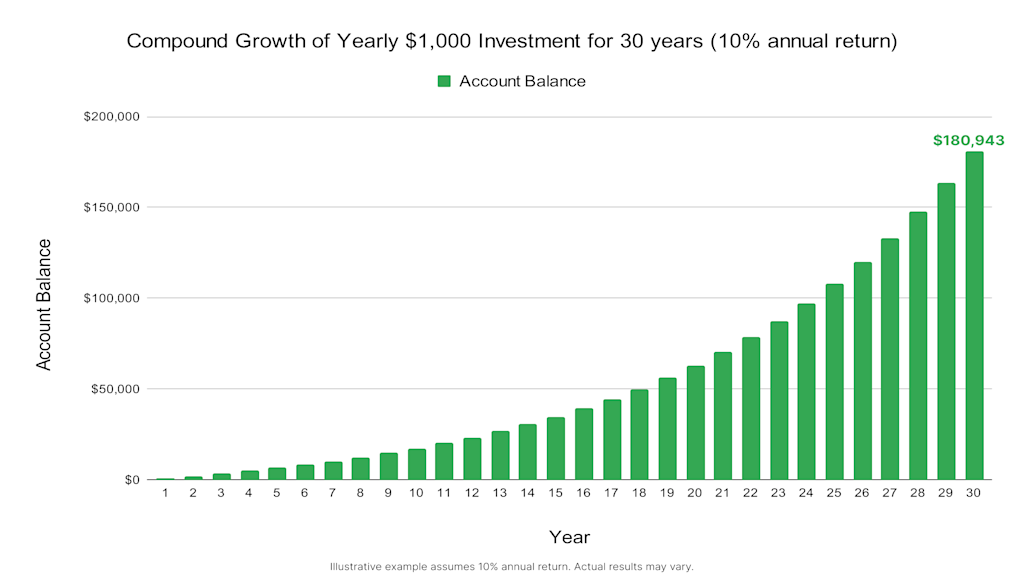

Compound Growth - Investing for the long term

Investing over long periods can potentially lead to large gains due to the power of compound growth. This is illustrated with simple examples that show how investment gains can grow after several years of compounding growth.

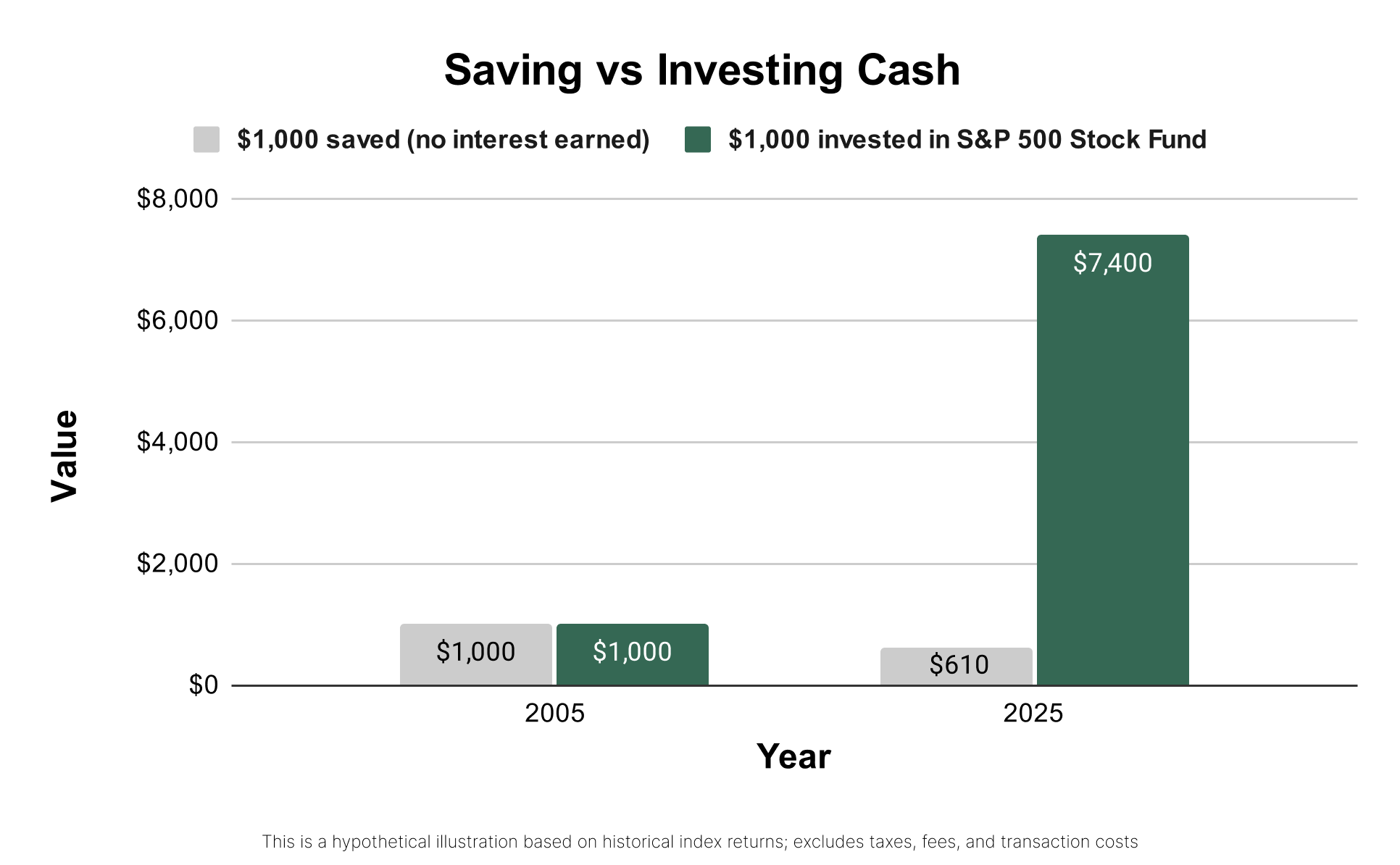

Cash vs Inflation

If you’re not earning interest on the cash you have saved it’s losing value every year because of inflation. Investing your cash can potentially have the opposite of effect - instead of your cash losing value because of inflation, your saved cash may increase as a result of investment gains.

10% Early Withdrawal Tax

While retirement accounts offer tax savings, they have specific rules for withdrawing your funds before the retirement age of 59 1/2 that may trigger an early withdrawal tax. Understand the rules for both Traditional and Roth IRAs and the situations where you can qualify for an early withdrawal exemption.